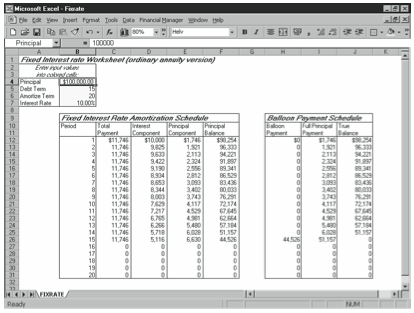

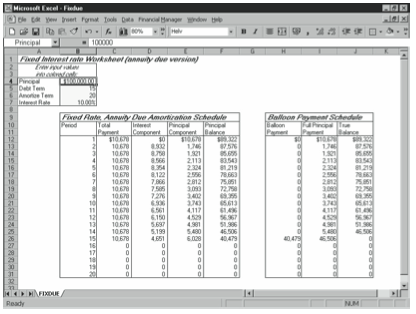

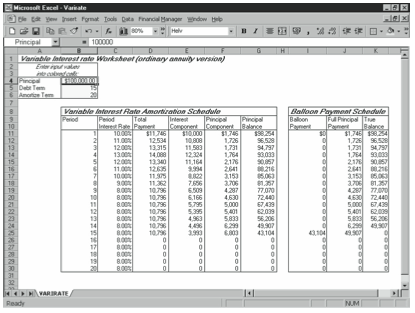

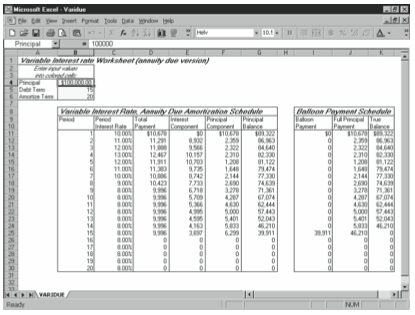

You can use the debt amortization starter workbooks, as shown in Figures 14-1 through 14-4, to construct debt amortization schedules for a variety of debt instruments.

Given four parameters—principal, debt term, amortization term, and interest rate—these starter workbooks calculate payment amounts, the interest and principal components of each payment, the outstanding principal balance for each period, and any balloon payments necessary to pay off the unamortized principal at the end of the debt term. You need this information to calculate profits and losses, to calculate cash flows, to report asset or liability balances on the balance sheet, and to calculate any gains or losses on the disposal of the asset or the refunding of the liability.

To enter your own data in a debt amortization starter workbook, follow these steps:

- Open the appropriate debt amortization starter workbook from the companion CD.

Use the fixed rate, ordinary annuity starter workbook if your debt instrument uses a fixed, or constant, interest rate and payments occur at the end of the payment period. Use the fixed rate, annuity due starter workbook if your debt instrument used a fixed interest rate but payments occur at the beginning of the payment period. Use the variable interest rate, ordinary annuity starter workbook if your debt instrument uses a variable, or floating, interest rate and payments occur at the end of the payment period. Finally, use the variable interest rate, annuity due starter workbook if your debt instrument uses a variable interest rate but payments occur at the beginning of the payment period.Note: The fixed rate, ordinary annuity starter workbook initially contains the default inputs shown in Figure 14-1. The fixed rate, annuity due starter workbook initially contains the default inputs shown in Figure 14-2. The variable rate, ordinary annuity starter workbook initially contains the default inputs shown in Figure 14-3. Finally, the variable rate, annuity due starter workbook initially contains the default inputs shown in Figure 14-4. - Specify the starting principal balance of the debt.

In cell B4, enter the starting principal balance of the debt. - Specify the debt term.

In cell B5, enter the debt term, in payment periods. - Specify the amortization term.

In cell B6, enter the amortization term, in payment periods. - Specify the interest rate or interest rates that should be used to calculate the interest.

For the fixed interest rate, ordinary annuity and the fixed interest rate, annuity due starter workbooks, enter the per-period interest rate in cell B7. For the variable interest rate, ordinary annuity and the variable interest rate, annuity due starter workbooks, enter the period interest rates in the Period Interest Rate column of the amortization schedule starting in cell C11.

After you enter the required inputs, the starter workbook makes the calculations necessary to create the debt amortization schedule.

Leave a Reply